This research post is about which companies have used customer experience to turn their brands into favourite brands, and how that happens. I am delighted to have co-authored it with Ian Golding, hugely renowned and respected customer experience specialist. The piece here is therefore also at his blog ijgolding.com where he has built a rich library of customer experience insights. To paraphrase what one of our top brands says, if you like this you’ll like what Ian has there too.

Ian introduces the research findings:

As I quite literally travel the world talking, listening and working with individuals and organisations who have an interest in Customer Experience, I am regularly asked who the world’s ‘best’ Customer Experience brands are. ‘Who is good at CX?’ is a pretty typical question. It is a good question to ask and one that I can most certainly answer ‘in my opinion’. However, having been asked the question so many times, rather than me just citing my opinion, I thought I would go a significant step further and ask as many people as possible for their opinions.

In January 2015, I conducted an independent survey of people across the world to find out who their ‘#1′ Customer Experience brands are and most importantly WHAT makes them their #1. In this blog post, I am delighted to officially reveal the findings of the research. Some of the findings may surprise you……some of them will not. What you can be certain of is that the findings are likely to provide validation of the things that are the most common reasons for these brands ‘delighting’ their customers.

Customer Experience is not just for the big, bold brands

The first big surprise for me was that 94 different brands were mentioned as people’s #1 Customer Experience brand in just over 200 responses . It is fascinating and encouraging to see that great Customer Experiences are not exclusively the preserve of those with huge budgets. Many of the companies named by respondents are small, independent businesses who share a similar mindset with brands we’re more familiar with. What is not a surprise though is that the top four favourite brands accounted for 40% of the responses. We’ll find out later why it is that the same brands keeping topping this kind of poll, but first, let me acknowledge the top 10 #1 Customer Experience brands coming out of the research:

Other well-known brands such as Emirates, Premier Inn, Argos, Airbnb, USAA and Sky all received endorsement as a #1 Customer Experience brand. In the interest of balance, some of the names mentioned by respondents that you are less likely to have heard of are as follows:

- Sixthman Music Festival Cruises

- Jabong.com

- Dutch Bros

- Discount Tire

- Hatem Shahim (a barber’s shop!)

- Dyreparken i Kristiansand

- Spear & Jackson

- Wegmans

- Firebox.com

- e-bolt

- Container store

Different countries and a variety of industries – the sheer number of organisations receiving a mention suggests that there are many doing something right – the question is – what exactly are they doing that warrants a customer such as you citing them as their #1 Customer Experience brand? Before we find out, let us just have a quick look at the commercial performance of the top 10 CX brands coming out of the research.

The right customer experience is commercially rewarding

The sheer mention of ‘Customer Experience’ and ‘Customer Centricity’, is still often greeted with a rolling of the eyes by those who are more focused on sales targets, operational efficiency and tasks. The irony though is that the former makes the latter much more successful. And it’s no coincidence that each of the top 10 brands has recent performance milestones to be proud of:

- Amazon Q4 14, net sales increased by 15% over Q4 13

- Apple 39.9% profit per product (3 months to end Dec 14)

- First Direct Moneywise “Most Trusted” and Which? Best Banking Brand

- John Lewis profit before tax up 12% in 2014 vs 2013

- Disney Earnings per share up 27% in year to Dec 2014

- Air New Zealand Earnings before taxation up 20% in H1 15 vs H1 14

- Mercedes Revenue increased 12% from 2013 to 2014

- Starbucks Revenue rise 13% in Q1 FY15

- BMW 7% increase in vehicle sales in Jan 15 vs Jan 14

- Boden Shipping 12,500 parcels each day

Pretty powerful stuff. Is it just a coincidence that the brands you are saying are the best at Customer Experience all seem to be faring pretty well on the commercial front? It appears as though all of the brands that are ‘great’ at Customer Experience share common characteristics – in fact the research identifies 13 common characteristics that are the reasons WHY these brands are #1 in your eyes. Lets us have a look at the ‘lucky’ 13!

These organisations have common characteristics

I wanted to know what it is that your favourite brands do to make them your #1 at delivering consistently good Customer Experiences. I asked for up to three reasons from each respondent and received 575 comments. Following verbatim analysis, 13 categories were identified, each distinct but interlinked. They were, as follows (with the percentage frequency they appeared):

- Corporate attitude 15.9

- They’re easy to do business with 14.9

- They’re helpful when I have a problem 11.4

- The attitude of their people 9.4

- Personalisation 8.0

- The product or service 8.0

- They’re consistent 7.5

- The way it makes me feel 6.3

- The way they treat me 5.1

- They’re reliable 4.4

- They do what they promise 4.2

- They’re quick 2.6

- The technical knowledge of their people 2.3

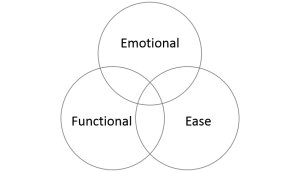

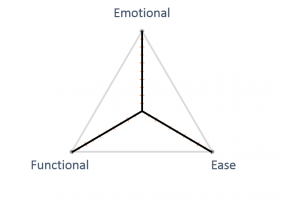

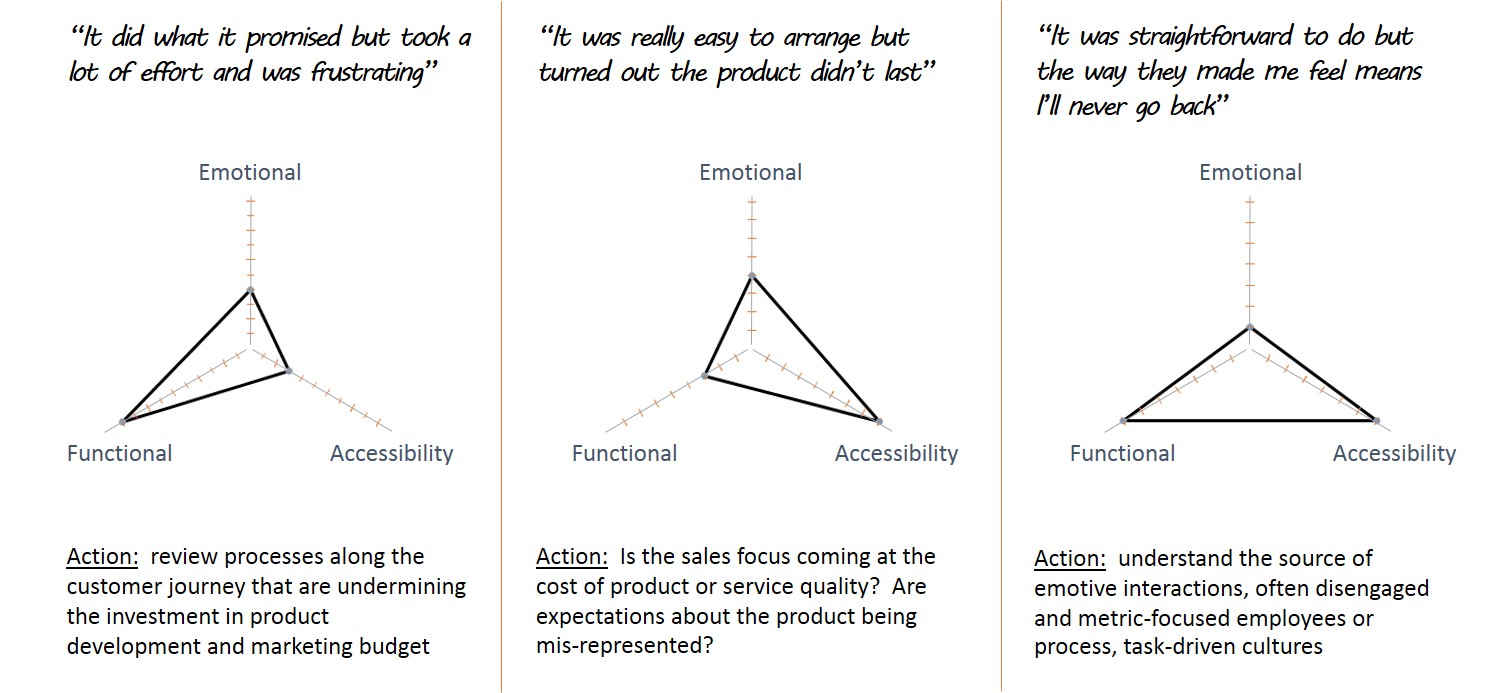

We will look in more detail at what we mean by each of these in a moment but to view at any one in isolation would risk limiting what is being achieved by these organisations. This diagram shows how interdependent each area is in aligning with the corporate attitude and ultimately organisational goals and the very purpose for why the business exists:

So what do the most favourite companies do, exactly?

Focusing on these attributes is what moves companies from fighting a rear-guard action to fix issues of their own making to creating a compelling a sustainable brand for the future. It also means that customers are increasingly exposed to better experiences as they go about their daily lives and that’s important because it keeps nudging the bar of expectations higher. This is why the brands that do these things are ones that people consider to be the very best at delivering consistently good Customer Experiences. Digging deeper into each of the 13 areas we can build a picture of how the companies who get it right control the way they do business.

1. Corporate attitude

It’s another way to describe organisational culture and it underpins everything that happens to or with a customer. More specifically, in the words of those who responded to the research, companies who have the right attitude:

- put people before profits and non-human automation

- know they’ll make more money in the long-run with this approach

- test all experiences thoroughly (to eliminate unintended consequences)

- listen and demonstrate they understand their customer

- pay serious attention to detail

- empower their staff to makes decisions and act straightaway

- stay true to their values, admit when things go wrong and fix them

- ensure their staff are fully trained and informed

- recruit for attitude and alignment to brand values

They also said: “…they treat each customer as we would a guest in our home” and “…they balance customer obsession, operational excellence and financial rigor”. Almost every other category is a sub-category of this one; it shows how important the right culture is.

2. They’re easy to do business with

It’s obvious to say a company should be easy to do business with and yet that’s not always the case. What respondents meant by “easy” included:

- there are no barriers in the way for doing what a customer needs to

- it’s simple to get information, purchase and use the product

- needs are anticipated and catered for

- customers don’t need to repeat information

- they can switch from one channel to another with no impact on progress

- products can be returned or fixed with minimum effort on the part of the customer

- they are available when and where customers want; they can be reached without waiting and won’t limit the hours of their support functions to office hours if customers are still using their products and services all day every day

- they are proactive in taking responsibility, eg finding products at other stores and having them delivered

- customers have no objection to self-service because it has been well thought through

- information is presented in a timely, clear and relevant way

3. Helpful and understanding when I’ve got a question

Being easy to deal with is critical when a customer needs help or simply has a question. On the assumption that good companies do respond (a recent Eptica survey found more than 50% of online inquiries go unanswered), helpful companies are ones who:

- listen to understand before acting

- give a customer the feeling that they are trusted and respected

- will provide an answer and additional, relevant help

- provide certainty and manage expectations about what will happen next and at each stage

- empower employees to make decisions

- resolve issues first time and quickly

- have employees who are happy to give their names and direct contact numbers

- preempt problems and solve them before customers are aware

- fix customers’ mistakes without blame or making them feel awkward

- follow-up afterwards to check everything was sorted and is still as it should be

- are not afraid to apologise when they get it wrong

4. Attitude of the people

Individual employees who are interacting with customers become a proxy for the brand. If they demonstrate the wrong behaviours the damage can be hugely expensive but getting them right does not cost a huge amount of money. Most often a function of the corporate attitude, the most appreciated characteristics are:

- being courteous and friendly

- a positive, “I’ll sort it” attitude

- they are good at listening

- it’s obvious they care about, and are proud of, the product/service

- they are professional and not pushy

- they are helpful and proactive

- they are genuine and humble

- they smile

- hey are engaging and interested in the customer

- they have personality, not a corporate script

- they are patient

- they show respect for their fellow colleagues

5. Personalisation

We are all individuals and like to be treated as such. Having “big data” was seen as the answer but as these companies demonstrate, it’s not only more important to have the right data and do the right things with it, but it’s also linked again to corporate attitude. Those who get the personalisation right:

- understand, anticipate and are proactive

- keep customers informed with relevant information

- shows they listen and act, not just collect feedback

- create a relaxed environment because a customer’s needs fits neatly into what they are offering

- create a feeling of respect, that they care and have “taken the time to know me, to make things easier for me”

- make it feel like dealing with a person where there’s a connection, not just a transaction

- allow their customers to control the degree of personalisation in terms of frequency and content

- remain flexible and adaptive to the circumstances, not scripted

6. The product or service itself

Making it easy, personal and rewarding will be wasted effort if the core product or service doesn’t live up to expectation. At the end of the day, your business has to have something of value to the customer to sell! When it comes to products and services, the #1 Customer Experience brands are those who:

- the right mix of choice, relevance, quality and innovation

- well designed, so it is easy to get it to do what it’s supposed to

- quality is complemented by relevant innovation, not technical innovation for the sake of it

- obsessive about the detail

- paying as much attention to secondary products, such as food on airlines

- good at turning necessary evils into compelling attributes – Air New Zealand’s legendary on-board safety briefings, for example

- adept at keeping up with, ahead of and shaping basic expectations

7. Consistency

As customers we like certainty and predictability. It means that the decisions we make carry less risk because we can confidently trust the outcomes. It also demonstrates stability of, and a shared understanding of, strategy. For our respondents, consistency is about experiences that:

- look and feel the same

- can continue easily wherever, whenever and however

- match or build on the positive expectations created last time

- have continuity in not only what happens but how it happens; tone of voice, quality, different locations, store or franchise, people and processes, performance

- provide the same reliable answers to the same questions

- integrate with other services

8. The way it makes me feel

Emotions are a function of how good the other two cornerstones of Customer Experience – function and accessibility – are. How they were made to feel, whether intentional or not, is what people remember. Being the personal consequence of most if not all the issues covered here, it is what drives our behaviour about whether or not we will do the same next time and tell others to do the same. If people think they are part of something special, connected to a company that lives by like-minded values, they will FEEL special. And as human beings, we appreciate that. Survey espondents cited a number of great examples:

- “get on an Air New Zealand flight anywhere in the world it already feels like you’re home”

- “the packaging increases the anticipation when opening a new product” (Apple)

- “interactions with employees don’t feel like processes out of an operating manual”

- “there is (the perception of) a genuine relationship; it’s not just about them selling every time they are in touch”

- “they make me feel as if I’m their only customer” (Land Rover)

9. The way they treat me

At the root of how we feel and therefore behave is often down to how we are treated. Good and great companies have experiences that:

- demonstrate respect

- show an empathy with customer needs

- don’t do things like asking a customer to repeat information if handed from one colleague to another

- keep customers posted on feedback they’ve given

- recognise their customers both by staff individually in-store and organisationally

- have a consistency of treatment even when not spending money in-store

- create relevant retail environments so that customers feel they are treated as if they are somewhere special

- develop meaningful loyalty programmes that acknowledge past purchases and reward future ones

- are not patronising in tone

10. They’re reliable

Not surprisingly, reliability is cited as a key attribute. Although we simply expect things to work as they did last time or as it was promised, we probably won’t get too excited if that is the case. However, the consequences of it not happening will result in additional time, effort, inconvenience and sometimes cost to the customer; not what a brand would want to be blamed for. There are some markets where the mere hint of a lack of reliability in its truest sense has serious consequences for a brand. More generally, reliable customer experiences are ones that

- give confidence and a level of trust that what we ask for when we buy is what we get; there are no nasty surprises

- understand that they are key to repeat purchases and advocacy. No-one will put their own reputation on the line to recommended any brand product or service that is unreliable

11. They do what they promise

Again, this is a character trait we appreciate in friends, family and colleagues and it’s no different when dealing with a business. It can be seen as a subset of “the way they treat me” but it is also critical at a strategic level too; the brand is what people say it does and so that has to be consistent with what it’s promising, just as its employees need to keep their own promises to customers too. There’s a real financial benefit here too where unnecessary and costly rework can be avoided. How many enquiries coming into the business are because “You said you’d get someone to call back”, “You said you’d send me a copy of that statement” or “Where’s my fridge, I’ve had to take the whole day off work and there’s still no sign of it”. Customer experiences that do what they promise:

- live up to the expectations they set

- have employees that do what they say they will do

- do it all consistently

- fix it quick if they fail

- are good at managing expectations

12. Quick

As customers, time (alongside money) is a commodity we trade with. A company who appreciates the finite and precious nature of it will create a distinct advantage. In today’s everything-everywhere-now life it’s not surprising that speed is an issue. Expectations are rising all the time where customers interacting with other brands see what can be done. Quick customer experiences are ones that:

- move at the right speed for customers

- show respect by having have good reaction times once a customer has initiated part one of a two-way activity

- manage expectations, so if it’s not “quick” as defined by customers there are also, no disappointing surprises

- are not just focused on speed of delivery but are quick to answer the phone, flexibility to find ways around rules and respond to questions

13. People knowledge

Having people who are technically competent with their product knowledge is another character of top brands. Companies that possess employees like this have an invaluable asset who are:

- able to translate the concerns and questions

- able to articulate complex issues in simple language

- are not patronising

- are proud that their knowledge can help someone else

So what?

There is no shortage of good and great experiences to learn from and they bring favourable commercial results to the companies that do have them. They don’t have to be high-tech out-of-this-world experiences; simply knowing what the basic expectations are should not be that hard and delivering them well time after time should just be the norm. This independent research also shows that it’s a combination of characteristics that matter, not one in isolation. That said, experiences, customers and balance sheets are always given an essential boost where having the‘right attitude’ is the common thread running right through the organisation.

Thank You!

A huge thank you to all those who participated in this research – without you giving up your valuable time and insight, I would not be able to share such valuable output.

An even bigger thank you to my friend and colleague, Jerry Angrave. Not only has Jerry co-authored this post, he also conducted the detailed analysis of the research results. A brilliant CX mind, he is also one of the most genuine Customer Experience practitioners I have ever met. You can read more of Jerry’s work at empathyce.com – I strongly encourage you to do so!

… and thank you to Ian too. I hope you found the post interesting but if you have any questions or other brands who you think should top the list, do get in touch. We’ll also shortly be looking at the opposite side of things and what customer experiences turn brands into our least favourite so watch this space!

Thank you,

Jerry Angrave | [email protected] | +44 (0)7917 718 072

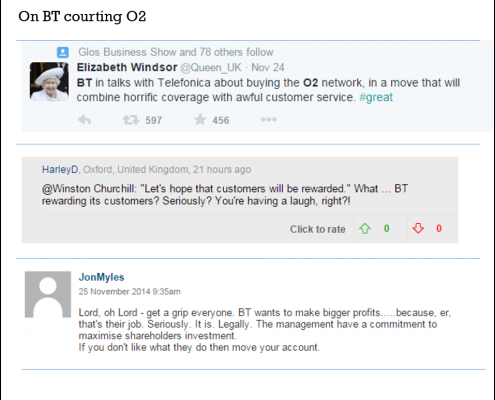

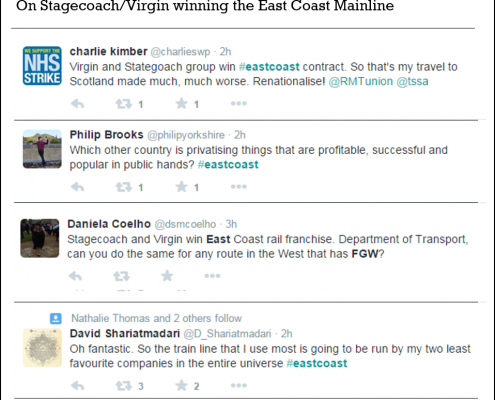

But, what will customers make of it?

But, what will customers make of it?