Why wouldn’t we make customer experiences easy?

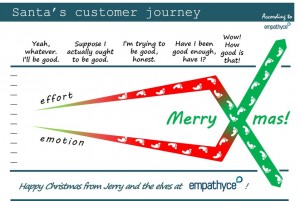

Last week I had the pleasure of speaking at an event about how to nurture a customer-centric culture. One of the key issues I referenced is that too often we have a gap between the sky-high corporate ambition (such as “to be the world’s best customer experience company”) and the lower-altitude commitment to making that a reality.

We see the consequences of that misalignment regularly. Just in the last couple of days alone I’ve experienced a tale of two cultures. Two very simple questions put to two organisations with two very different results.

I’m sharing them in the hope that one inspires and the other prompts us to ask ourselves, “Could that happen in our business?”.

Firstly, my bank. I had a general enquiry about one of their processes. A client bounced a cheque on me so the bank had automatically represented it. When it was returned the second time I was charged for the pleasure. So, I wanted to know what the bank’s policy was on how many times they would represent the cheque (and therefore how much I’d be charged too).

Their brand proposition proudly talks about wanting “to help businesses thrive…to help people realise their ambitions”. But they’re one of the world’s biggest players anyway and as I had a simple question my expectations of a quick response were high.

My problem though was not that I didn’t get an answer. More, it was ridiculously difficult to ask it in the first place.

My first attempt started after 10pm and the helpline was closed. Fair enough, though people managing their own businesses necessarily tend do the admin at either end of the day. I resorted to the FAQs on the website but after much trawling there was nothing relevant . The LiveChat was not live either.

So next morning I called back. The IVR route made me enter my branch sort code number. Then I needed to type in my account number followed by my date of birth and two digits from my security PIN. For some reason I then had my balance read out automatically. Twice. Topped off with a declaration about the difference between the balance and cleared funds.

I then had to navigate three further levels of IVR options before listening to the on-hold music for five minutes. Then someone picked up the call.

At that point they very helpful. The question was answered inside a minute. Added to the time I’d spent the night before though, the effort to get that point was disproportionate. I only hope they measure customer effort rather than, or aswell as, overall advocacy otherwise things won’t change.

Compare that with my second experience the same day. Next week I’m chairing sessions on passenger experience at the Rail Festival in Amsterdam. I was wondering how I get from Schiphol airport to the city centre by train. So, when a reminder about my flight popped up on my KLM app with a very clear ‘Contact Us’ button I sent them a quick question via Twitter (I could choose which messaging platform to use).

I sat back and carried on with my evening. Twelve minutes later, I had a response from the airline pointing me to where the rail ticket office is inside the airport. Sorted, with very little input from me.

But more than that, after only nine minutes, a delightful lady who runs a company helping law firms in Holland intervened and forwarded my request directly to the rail company, NS. They too then quickly confirmed what I needed to do.

Not only were the airline and rail company right on top of things, one of their own customers was willing to help another. I was very grateful but also intrigued about why she’d done that. She told me the motivation was that she is very proud of the Netherlands and wanted to help anyone who was visiting her country. Her intent was not so much to help the airline or rail company directly but subconsciously had confidence the issue would be resolved quickly.

And indeed, I’d had a swift response. But beyond her wider motive I thought about rail passengers in this country. If we happened to see a message from someone coming to the UK and they’d asked the airline about rail travel here, would we put our own reputation on the line by trying to help out? Would we be so confident that the rail operator would pick up the baton so quickly and easily? Hmmm.

They say the experience on the outside reflects the culture on the inside. If it feels like wading through treacle to get answers to simple questions then that business is more than likely carrying excess costs. If it’s easy for customers there’s less processing and support needed from the business. Unnecessary complexity also does nothing to support the wider brand promise; quite the opposite. If the reality of the experience is working against the expectation so much of the Marketing budget is wasted.

It’s easy to set sky-high ambitions but as CX professionals we need ensure there are no gaps between them and what it’s really like to be a customer. As KLM and NS have shown, if it can be easy, why wouldn’t it be? We already know that better experiences mean customers will come back more often, spend more and tell others to do the same. And if that then makes customers feel willing and able to help others customers too, that’s got to be a win for everyone, surely.

(Oh, if you’re interested, in the UK a bank will usually represent a cheque four times. Some though apparently will keep representing many more times, conveniently charging you each time. Be warned!).

———————

Thank you for reading the blog, I hope you found it thought-provoking.

I’m Jerry Angrave and I help people in Customer Experience roles do what they need to do. I’m a CCXP (Certified Customer Experience Professional) and am one of a handful of people globally who are authorised by the CXPA to train CX professionals for its accreditation. I founded Empathyce after a long career in CX and Marketing roles and am now a consultant and trainer.

Do get in touch if you’ve any comments on the blog, any questions or are interested in training or consultancy support.

Thank you,

Jerry

[email protected] | www.empathyce.com | +44 (0) 7917 718072

But, what will customers make of it?

But, what will customers make of it?